Gold and silver are the most popular metals for investors, but some prefer options like platinum, palladium, and copper. No matter what you choose for your investment or collection, you need to know the different bullion products that you’re likely to encounter.

This guide is, therefore, the path to understanding. We are going to walk through the different types of bullion products you’ll see, along with some recommendations about our favorite picks. Whether you are a new investor learning the ropes or an experienced stacker brushing up, you will find something you need below.

What is bullion?

The word “bullion” is a catch-all term for any precious metals that you can purchase. Any piece of bullion has undergone significant refining from its initial discovery as ore and is now concentrated into a solid piece of (mostly) the metal itself.

What follows, then, are the three most common formats in which you can invest in bullion. Each format has its own advantages and drawbacks, but there is no truly “wrong” choice among the three as investment vehicles. It’s mostly a matter of preference on your part.

![]()

The three types of bullion you’ll mostly find are:

- Coins

- Rounds

- Bars

What makes a piece of bullion a coin?

A coin is a piece of bullion that has been minted, stamped, and issued by a sovereign government. As such, a coin can be and is often used as legal tender within its country or area of origin. The US quarter or the British pence are prime examples of coins that are valid currencies for exchange in their jurisdictions.

However, not every coin minted by a sovereign government makes its way to the general public. Such coins, which are usually pressed for collectors or other special owners, are known as “bullion” coins. Coins that end up in our pockets are termed “circulation” coins because they are, well, in circulation in the public.

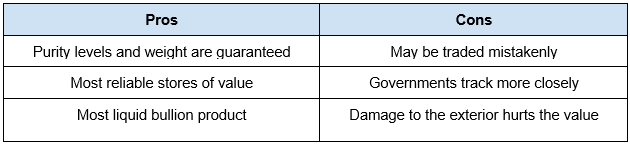

Here are the pros and cons of investing in coins:

What are bullion rounds?

A bullion round is a circular disk of precious metal. You may also hear rounds called wafers or casts from time to time.

At first glance, there isn’t much difference between coins and rounds. They are usually close in size and shape. However, a round is issued by a private mint, not a government, and bears no value as currency on its own.

Instead, a round’s value derives from the value of its metal content only. In that, a round is much more akin to a bar than a coin, despite its similarities in shape and size to a coin.

Here are the various pluses and minuses associated with investing in rounds:

What are bars of bullion?

A bar is a slab of concentrated precious metal. It may also be called an ingot, depending on where you are.

In general, a precious metal bar is available as a three-dimensional rectangular object. This shape makes them easier to stack and store. However, as these derive their value from their metal content, the truth of the matter is that a bar can be in almost any shape.

Because of their most common shape and/or shape flexibility, in certain cases, bars are favored by investors due to their ease of storage. They are the easiest way to stockpile gold in your collection.

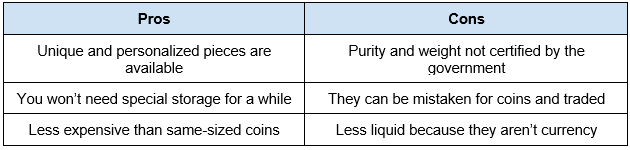

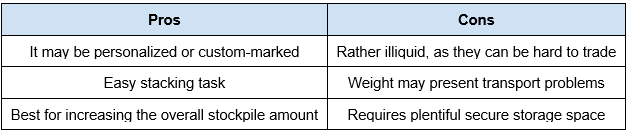

However, though bars have many benefits, they are not a perfect investment option. Here are the different things to consider about them:

What is the best type of bullion product?

There isn’t one. While we have our own preferences, everyone is in a different situation.

The best thing to do is figure out what your goals are for your investing. Then, consult the tables above to determine which product or products will make it easiest for you to achieve those goals.